Accounting - An Introduction

A D V E R T I S E M E N T

This Chapterintroduces you to accounting as a

profession, and as it is used to make financial and business decisions. Billions

of dollars exchange hands every day, in millions of separate business

transactions. These are recorded and reported on using a comprehensive set of

guidelines, referred to as Generally Accepted Accounting Principles (GAAP).

Accounting - n. The bookkeeping methods involved in

making a financial record of business transactions and in the preparation of

statements concerning the assets, liabilities, and operating results of a

business.

System - n. A group of interacting, interrelated, or

interdependent elements forming a complex whole.

Accounting System - the people, procedures, and

resources used to gather, record, classify, summarize and report the financial

information of a business, government or other financial entity.

Double-entry bookkeeping - the practice of recording a

business transaction in two equal parts, called debit and credit entries. Debit

refers to the left column and credit refers to the right column, in an

accounting journal.

Each transaction describes both:

(1) the object of the transaction - such as rent, telephone, or

payroll expense; sales, fee or interest revenue.

(2) the source of payment - cash or credit.

Money eventually changes hands in (almost**)

all transactions, either at the time of the transaction, or perhaps at a future

date in the case of items purchased on credit. Sometimes a transaction involves

cash directly, at the time of the event, such as a cash sale at a grocery store.

It is more common, and safer, to use a checking account for routine purchases.

These are all considered part of the Cash account.

Many, and perhaps most, transactions in a

business take place on a credit basis. Businesses usually purchase their

supplies and merchandise on a 30-day account, known as a trade account, or

Accounts Payable. Sales are typically made in a similar fashion, called Accounts

Receivable.

**Adjusting and closing entries

are not typical, and represent special entries made by accountants to prepare

financial statements, and reset certain accounts at the end of a fiscal year.

Marble tablet: Account

of Disbursements of

the Athenian State

c. 418-415 BC

A short history of accounting

Accounting was born before writing or numbers existed, some

10,000 years ago, in the area known as Mesopotamia, later Persia, and today the

countries of Iran and Iraq. This area contains the Tigris Euphrates river

valley, a large fertile area 10,000 years ago with a large thriving population

and active trading between towns and cities up and down the two rivers.

Writing and numbers would be not be invented for about

another 5,000 years. And what happens next will directly lead to the invention

of both writing and number systems.

At that time, merchants faced many of the same problems

businesses face today. They had to ship their merchandise up and down the

rivers, and that meant trusting a boatman with their goods. Unfortunately, not

all boatmen were honest, and disagreements often arose about how much was

shipped versus what was received at the other end.

It is hard for us today to imagine a world without writing

and numbers. Try to imagine yourself in their position.... what would you do?

To deal with the problem, merchants came up with an ingenious

plan. They made small clay tokens, in various shapes and with various markings,

to indicate different products. One would mean a basket of grain, another would

mean a pot of oil, etc. They had over 200 such tokens to indicate a large

variety of common goods, including food, leather, clothing, utensils, tools,

jewelry, etc.

Bollae and tokens circa 3300 BC

Before shipping their goods, a merchant would take one token

for each item in the shipment, and encase the tokens in a ball of clay, called a

"bollae" (pronounced "bowl-eye") - meaning ball. The ball would be dried in the

sun, given to the boatman, and then broken by the buyer on the other end of the

transaction. The buyer would match the tokens with the items in the shipment, to

verify that everything sent was accounted for.

This is the function of protection of assets, and is a

major function of all modern accounting systems. It was important 10,000 years

ago and is just as important now. Today we see merchants doing the same thing as

their counterparts 10 millennia ago - today they get a bill of lading - a

listing of the merchandise entrusted to a shipper.

The system of using bollae continued for almost 5,000 years,

all before the invention of writing or numbers. One day, probably by accident, a

wet clay bollae was rolled over a loose token, laying on the ground. The

impression of the token was left in the wet clay. Merchants began pressing the

tokens on the outside of the bollae, in addition to putting the tokens inside

the ball.

Eventually they would press tokens into a flat piece of clay,

leaving an impression for each item. Remember, they didn't have numbers yet, so

they would press a token into the clay for each individual item. Probably by

accident one day the right token couldn't be found, and someone used a stick or

other object to make the right marks in the soft clay tablet. And writing was

born...

New symbols were soon created representing multiple items,

and suddenly both writing and number systems were invented. The last phase of

this remarkable process took about 500 years, but once writing was invented, it

caught on like wildfire, and was the most popular thing anyone had ever seen.

People were so much in love with writing they did it every

chance they could. We have a huge amount of archaeological evidence to support

this notion. Thousands of small clay tablets still survive today.

A common example: a worker sent his boss a note saying he

would be late for work that day because he had chores to do. He would hire a

scribe to write the tablet (only a few people could read or write), and hire a

child to carry the note to his boss. They sent notes like we use the phone

today, and they loved it. They wrote for the sheer joy of it - the ability to

communicate at a distance.

Written accounting records are some of the oldest writings

that have survived until today, and they date back to circa 3300-3200 BC. These

early records were simple single-entry listings of wages paid, temple assets,

taxes and tributes to the king or Pharaoh. This simple system was used until the

mid-1400s, and a period known as the Renaissance.

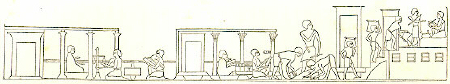

Picture in the Tomb of Chnemhotep, pharaoh of Egypt circa 1950

BC. The ancient Egyptian scribe (seated on the left) prepared his accounts on

papyrus with a calamus. The accompanying text reads "Minute care is not only

taken in the case of large amounts, but even the smallest quantities of corn or

dates are conscientiously entered." In ancient Egypt, the accountants were

literally bean-counters. They also counted rice, beer, and everything else.

Ancient Egyptians were paid in "kind" - they had not invented money yet so

workers were paid with food, beer, clothing, etc. (Everyone drank beer back

then, because it was more sanitary than the water. The alcohol content was very

low, because they used a short brewing process. )

It is interesting to note that the Mediterranean and European

nations had no concept of the number zero until the middle ages. They learned

the concept of zero from Middle Eastern mathematicians, who also knew about the

movements of the stars and planets, and had figured out the earth was round, and

revolved around the sun in an orbit, etc. It took the Europeans another 500

years to figure that out, largely because those concepts were contrary to views

held by the Roman Catholic church at the time. It's also hard to do math using

Roman numerals, so their math skills were limited until they started using

Arabic numbers.

| c. 8500 BC |

c. 3500 BC |

c. 3000 BC |

c. Late 1400s |

| merchants begin to use bollae and tokens to protect

shipments |

scribing marks onto wet clay replaces use of bollae

& tokens |

writing & number systems fully developed & in use |

Luca Pacioli documents double entry accounting |

By the time Christopher Columbus was trying to sail west, a new

form of accounting was in use by merchants in Venice . Luca Pacioli

(pot-chee-O-lee) set down in writing for the first time a description of the

double-entry system of accounting, which we still use today in much the same

form. Alhough he didn't actually invent the system he is called "the father of

accounting" for his contributions and for documenting the system in his fifth

book on mathematics Summa de Arithmetica, Geometria, Proportioni et

Proportionalita (Everything About Arithmetic, Geometry and Proportion).

Written as a digest and guide to existing mathematical

knowledge, bookkeeping was only one of five topics covered. The Summa's 36 short

chapters on bookkeeping, entitled De Computis et Scripturis (Of Reckonings

and Writings) were added "in order that the subjects of the most gracious

Duke of Urbino may have complete instructions in the conduct of business," and

to "give the trader without delay information as to his assets and liabilities"

(All quotes from the translation by J.B. Geijsbeek, Ancient Double Entry

Bookkeeping: Lucas Pacioli's Treatise, 1914)..

Luca

Pacioli was a remarkable man. He was one of the best mathematicians of his time,

and was a close friend of Leonardo DaVinci. They collaborated on many projects.

Pacioli helped DaVinci lay out his painting, The Last Supper, with

mathematical precision. And Leonardo illustrated Luca's books on mathematics and

accounting. History is full of instances of collaboration between these two

great thinkers and Renaissance men.

Luca

Pacioli was a remarkable man. He was one of the best mathematicians of his time,

and was a close friend of Leonardo DaVinci. They collaborated on many projects.

Pacioli helped DaVinci lay out his painting, The Last Supper, with

mathematical precision. And Leonardo illustrated Luca's books on mathematics and

accounting. History is full of instances of collaboration between these two

great thinkers and Renaissance men.

Modern accounting follows the same principles set down by

Luca Pacioli over 500 years ago. However, today it is a highly organized

profession, with a complex set of rules for the fair disclosure and presentation

of information in financial statements. Every day trillions of dollars in

transactions are recorded by business, government and financial institutions

world-wide. They all follow the same general set of rules.

In the United States, we follow Generally Accepted

Accounting Principles (GAAP) as specified by the

Financial Accounting Standards

Board (FASB). We use the US Dollar for all financial statements and

transactions. Other countries use similar accounting rules as the US, but there

are differences from country to country. If you had a business in France, you

would use the French equivalent to our GAAP.

GAAP developed over 500 years from the basic concepts Luca

Pacioli set forth in the 1400s. There is a great deal of similarity in

accounting practices around the world because they all have a common origin.

What accountants do....

Many people incorrectly believe that accountants' work primarily

consists of bookkeeping. Most professional accountants do little or no

bookkeeping. Accountants are involved in the preparation of financial

statements, and the interpretation of financial information, rather than

day-to-day recording of routine transactions. This work includes making sure the

financial statements comply with GAAP, provide adequate disclosure of essential

financial information, and are free from material errors and misstatements.

Legal and Business Info

Forms of Business Organizations

Sole Proprietor - One owner

Partnership - 2 or more owners

LLC - 1 or more owners (as allowed by state law)

Corporation - unlimited number of owners (stockholders)

The business entity is the legal form the owners have chosen,

depending on their particular needs. The legal form will determine how the

company will file tax returns and the owner's individual exposure to legal

liability for lawsuits brought against the company.

Corporations and LLCs both provide a layer of legal

protection for the owners. Sole Proprietors and General Partners are exposed to

unlimited legal liability. This is why most business are organized as

corporations. The LLC form has been available in the US for about a decade, but

has become a very popular business form. The number of LLCs is growing rapidly,

but the predominant business form is still the corporation.

The Balance Sheet presentation and accounts used will vary

depending on the way the company is organized. Sole Proprietorships use the

Owner's Equity account. Corporations have accounts for stock and retained

earnings. Partnerships have accounts for Partner's Capital, contributions and

distributions. LLCs may be organized like a corporation or partnership, and

will use the appropriate set of accounts depending on how the company is set

up.

|